FOK

Fill or Kill. It means that the order is to be matched, immediately after submission, at the exact quantity specified in the Qty field or else it will be canceled automatically by the system at once.

FAK

Fill and Kill. It means that the order is to be matched, immediately after submission, as much as possible, up to quantity specified in the Qty field and the remaining unmatched portion, if any, of the order will be canceled automatically by the system at once.

Today

Rest of day (default). It means unmatched orders will remain in the central order book until the market close of the day.

GTC

Until Expiry. It means that unmatched orders will remain in the central order book until the market close of the expiration day of the product.Unmatched orders without expiry date will be valid until traders further instruction,i.e.Good Till Cancel Order.

Date

Specified Date. It means that unmatched orders will remain in the central order book until the market close of the business date specified in the Date field.

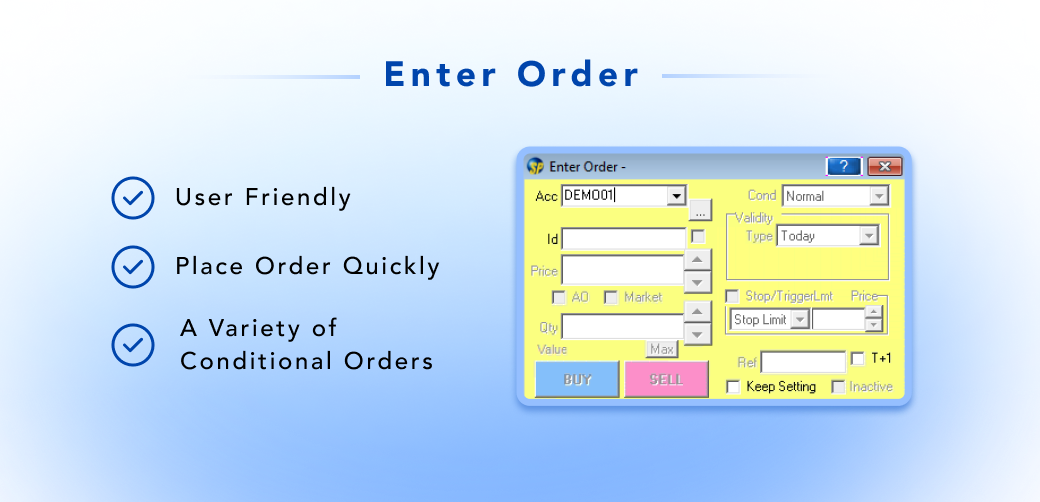

Ref: Free text information. Client information or any other free text information can be entered.

Inactive: An inactive order. It is not a tradable order unless user activates the order, place to the market.