Advanced Order Entry

Advanced Order Entry combines both "Enter Order Entry" and "Quick Order Entry" function with the use of various hot keys, aims at speeding up users' order processing. Following describes this new function:

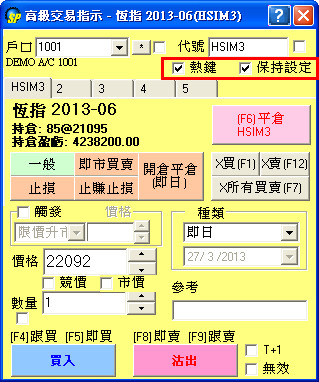

[Keep Setting]

Lock up the last order entry details for next input.

[Hotkey]

To speed up order entry with keyboard hotkey.

【Hotkey】List

| F1 | Cancel all "Buy" orders of a product |

| F12 | Cancel all "Sell" orders of a product |

| F7 | Cancel all orders of a product |

| F4 | Buy Bid |

| F5 | Buy Ask |

| F6 | Close Position |

| F8 | Sell Bid |

| F9 | Sell Ask |

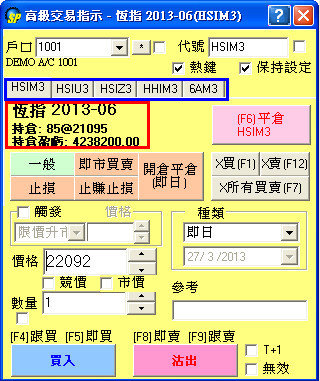

[Support mulit-products order entry page]

Clients performing multi-products trading can set at most 5 different products' order entry page.

Each order entry page is specified to a single product with its own position details(i.e.quantity, price, Profit/Loss, etc).

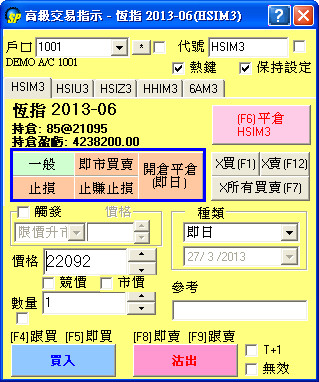

[Conditional Orders]

Advanced Order Entry includes the following 5 different order entry types:

- Normal

- Market

- Stop Order

- OCO

- Open&Close(Today)

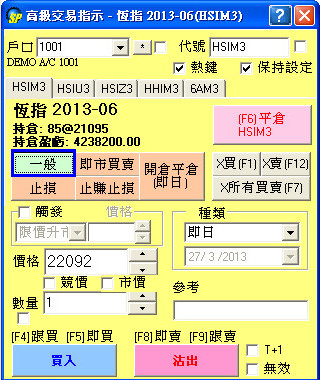

[Normal]

Terms description:

| Acc | User's account number |

| Id | Product Id |

| No Position To Close/Close | No position to Close: No existing contracts to be close; Close: Stop holding position and sale |

| XBuy | Cancel all "Buy" Orders of a product |

| XSell | Cancel all "Sell" Orders of a product |

| XAll | Cancel all orders of a product |

| Price | Order price |

| AO | An auction order. An order that does not have a price limit assigned. An auction order is ready to be matched at the Calculated Opening Price (COP) during the Pre-market Opening Period. At the end of the Pre-market Opening Period all unmatched auction orders will be converted to either limits orders or inactive orders. |

| Market | Place order to hit market price. Applicable to certain foreign exchanges only,i.e.not applicable to HKEx. Details please contact the brokerage house. |

| Qty | Order quantity |

| Ref | Free text information. Client information or any other free text information can be entered. |

| Inactive | An inactive order. It is not a tradable order unless user activates the order, place to the market. |

| T+1 | Support HKEx night session trading(only show after sptrader r8.46 version) |

Trigger:

| Condition | Usage |

| Up Trigger | If market price is larger than trigger price, then the order will be place in the market. |

| Down Trigger | If market price is less than trigger price, then the order will be place in the market. |

Type(Validity type):

| Today | Rest of day (default). It means unmatched orders will remain in the central order book until the market close of the day. |

| Fak | Fill and Kill. It means that the order is to be matched, immediately after submission, as much as possible, up to quantity specified in the Qty field and the remaining unmatched portion, if any, of the order will be canceled automatically by the system at once. |

| Fok | Fill or Kill. It means that the order is to be matched, immediately after submission, at the exact quantity specified in the Qty field or else it will be canceled automatically by the system at once. |

| GTC | Until Expiry. It means that unmatched orders will remain in the central order book until the market close of the expiration day of the product. Unmatched orders without expiry date will be valid until trader's further instruction, i.e. Good Till Cancel Order. |

| Date | Specified Date. It means that unmatched orders will remain in the central order book until the market close of the business date specified in the Date field. |

(2)Market

Quick Order Window is used to get market price quickly. Client should input the Id, Lots, Ticks, Hot key and then can trade.

2 Types of orders are supported: "Hit Buy/Sell"(Hit over/up to market price to trade) or "Join Buy/Sell"(Place orders at price down to a certain level to wait in market). Order validity can be set as "Today", "Fak" and "Fok".

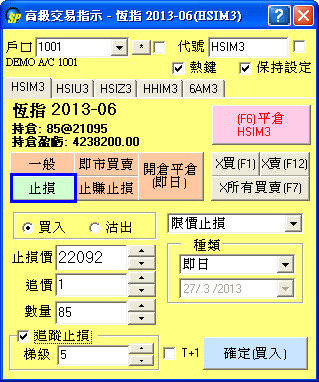

(3)Stop Order

Stop Limit Order can be set to limit loss when the market fluctates swiftly, while let the profit run as well.

Users just have to input the Buy/Sell, Qty, Level(trigger price),toler and finally click "confirm buy/sell" .

'Trailing Stop' function is also supported which allows the Stop Loss value to flow as the market price changes, while the baseline of stop loss value is still the original set one.

The "Step" is the change in stop level and price when market price has already moved according to the "step" value.

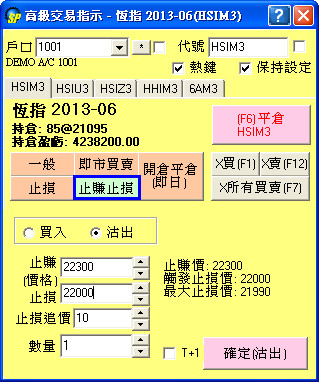

(4)OCO

This is an order that consists of both a Stop-Loss and a Limit order. Once one of the pair is filled, the other is canceled automatically. With OCO orders you know your exit points exactly.

(4)Open&Close(Today)

This function includes 2 steps: Open and Close position.

Users can choose "Up/Down Trigger" OR "Mkt" order types, and set the quantity to build up the Open position order.

After that, users have to set the Close position order with the use of "OCO(Points)/(Prices)" or "Stop(Points)/(Prices").

-"OCO(Points)/(Prices)" :Users have to set conditions on profit level("Profit Pts/Prc") and stop level("Loss Pts/Prc" with "toler"). When market price reaches either one side, the condition will be triggered with the cancellation of another condition.

-"Stop(Points)/(Prices)" : Users have to set the "Stop level(Loss Pts)" and "Toler" , or with the combination of "Step" to place an order.

When both "Open Position" and "Close Position" order conditions are set, users can click "Buy/Sell" to send out requests and wait for order conditions to be fulfilled.

Besides, "Time to close" condition is added to trigger position to be closed at specified and market valid time within today.