Option Master Window

Open the window from the Market Menu. Here investors can find all kinds of options, Implied Volatility and risk parameter(Deta,Gamma,Theta,Vega), which are convenient to portfolio, dynamic hedge and as well as risk management…etc.

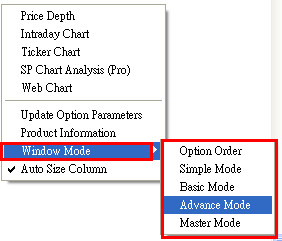

You can click small button in the right top corner of this window

to change window view. There are four view to select:

to change window view. There are four view to select:

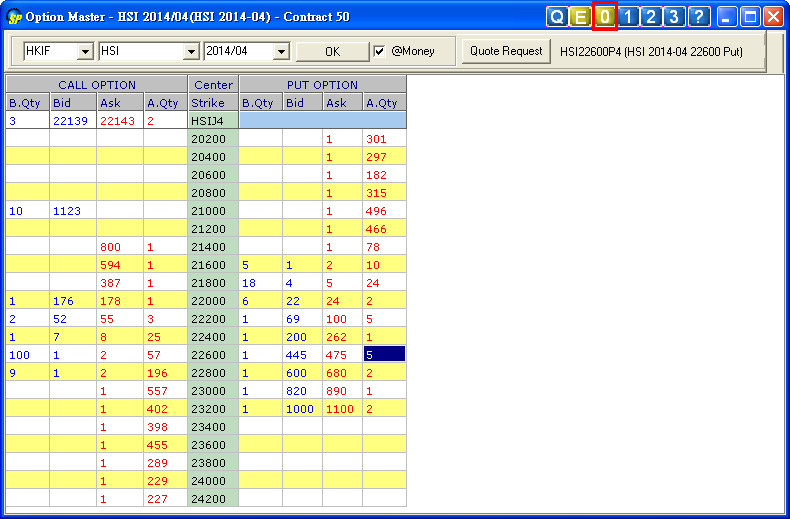

Simple mode only shows bid/ask price and quantity. This makes the screen easier for market price view and place order。

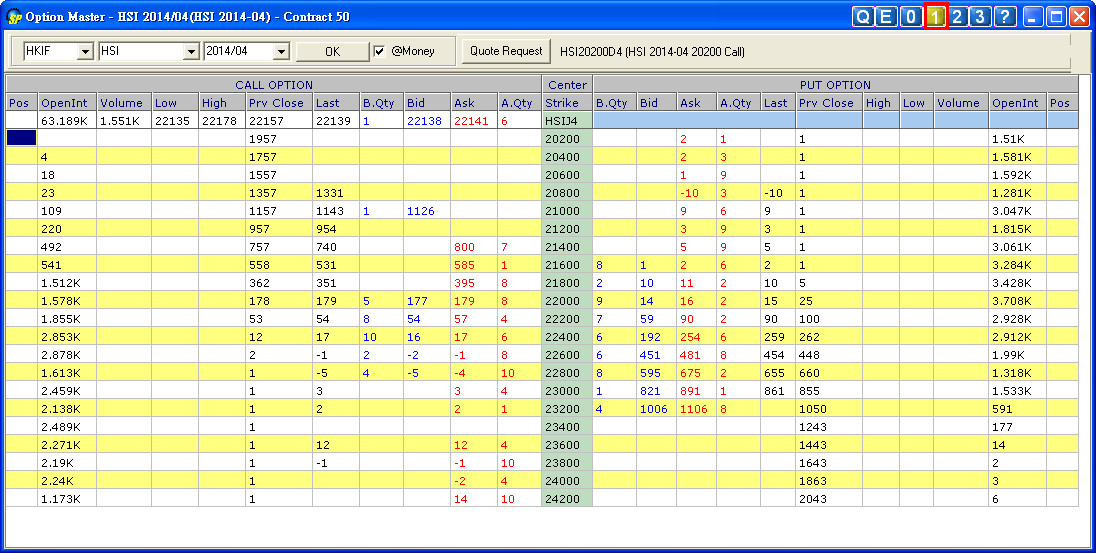

Basic Mode is to show the details about bid、ask、bid qty、ask qty, also trade price、trade volume and total trade volume.

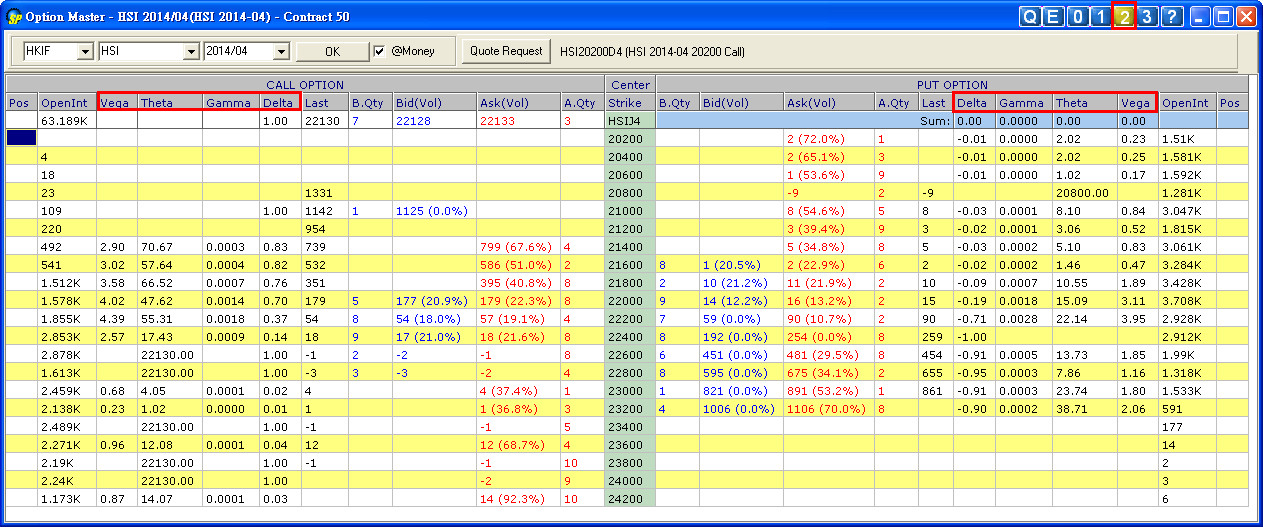

In the Advance Mode window, you can see all kinds of risk parameter(Deta,Gamma,Theta,Vega). The system will calculate these parameters for you and make trading easier.

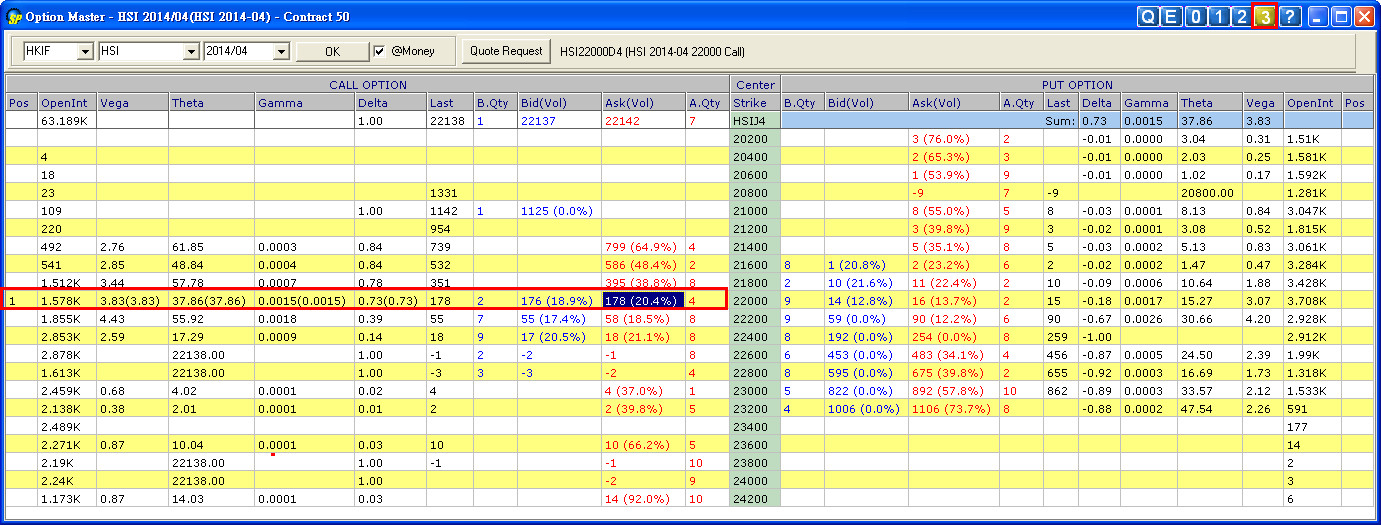

Master Mode is able to calculate risk parameter in real time according to your position, as well as to help you quickly know the market information and position risk.

Implied Volatility (IV)

Implied Volatility is the most important factors to evaluate the price of option. Implied Volatility is calculated from the options and their influence factors such as stock price, strike, time value, interest rate and bonus.

Delta

Delta means the change of stock price affect the price of option. If delta=0.5 mean that when stock price change 1yuan , option price will follow to change 0.5yuan.

Gamma

Delta’s value changed when stock price changed. Gamma is to show the degree of delta’s sensitivity. Gamma=0.1 mean that when stock price change 1yuan, delta will follow to change 0.1yuan.

Theta

The missing value about option everyday. If stock price and Implied Volatility didn’t change , Theta=0.01 mean that option price fall 0.01yuan next day.

Vega

Vega mean the price of option affected when Implied Volatility change 1%.

(Remark: Details on the above risk parameters please refer to

1 : Baidu

2 : Wiki )

The four modes can also be selected in Window Mode after right click on the option master window。

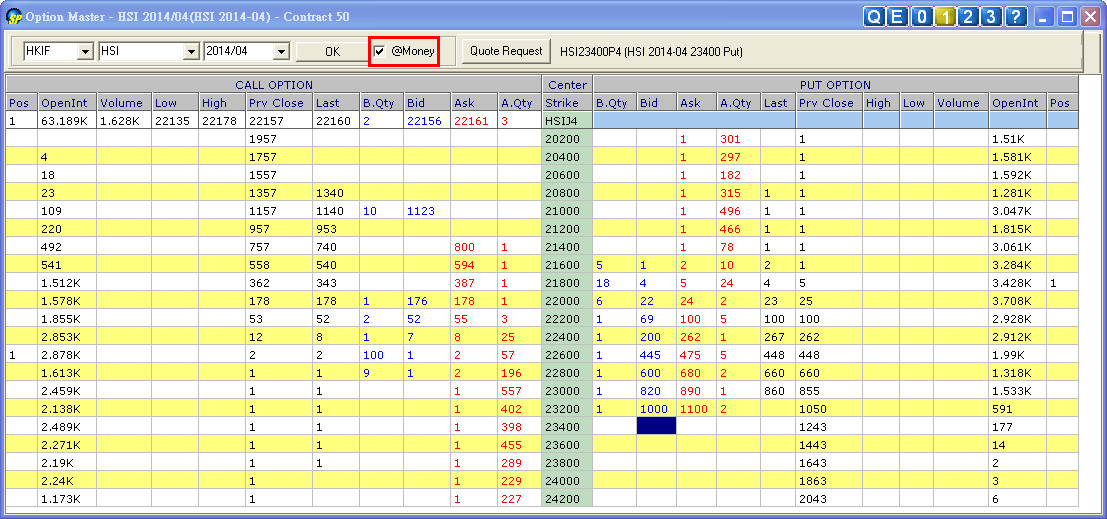

"At the Money" Option mode

"At-the-money" options(options active in the market and strike price close to the underlying future product) will be default shown after login into option master and choose option products with the box being selected.

This filters the inactive options and make the window easier for trading.

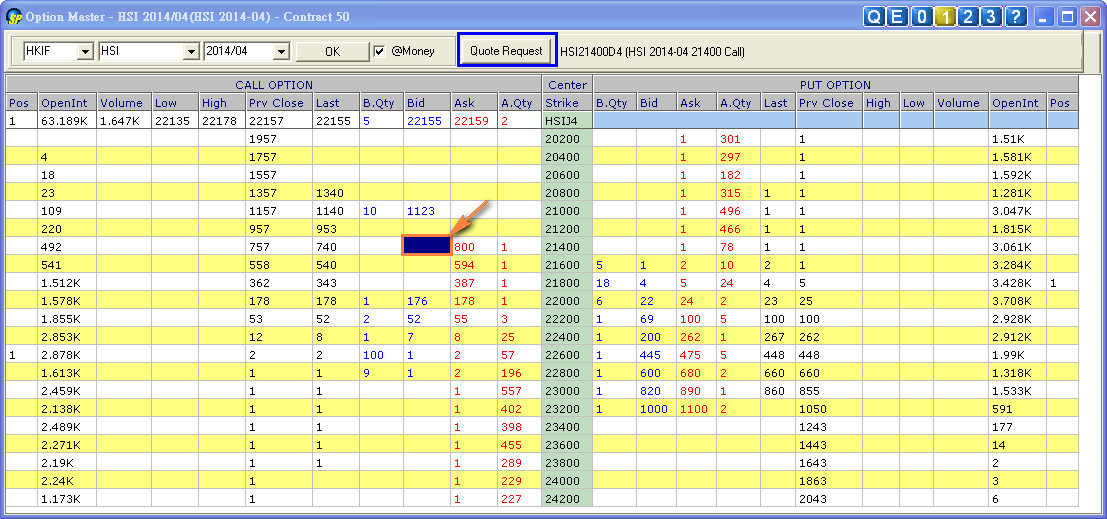

Quote Request

You can send a quote request to market maker. First, you click the “Quote Request” button. Then you will see the following window:

Input the information and then send your request.

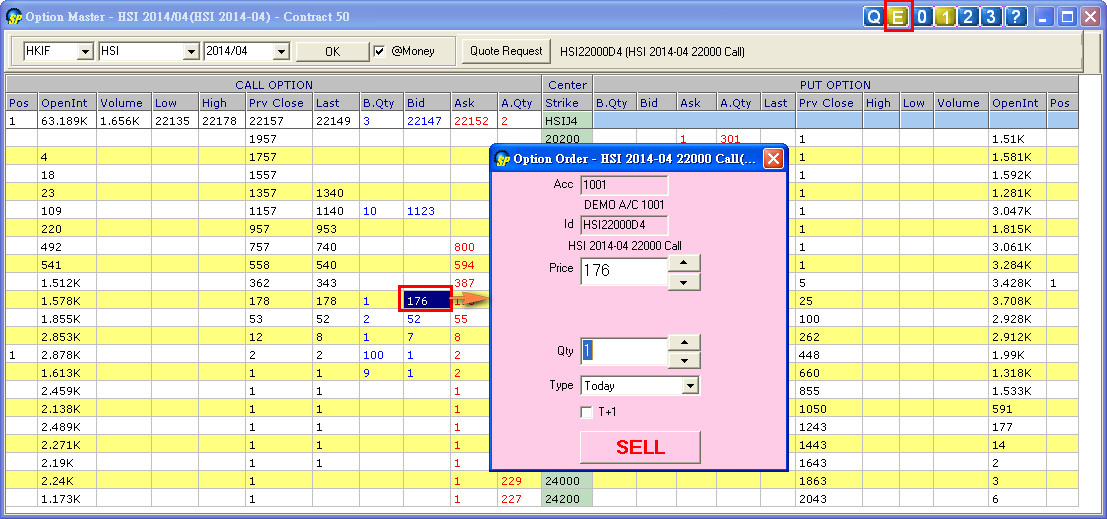

Option Order

The “Option Order” window can be called by pressing the “E” button on the top right corner of Option Master Window.

After pressing “E” and chosing a price on the window, you can call out the “Option order” and place positions. FAK (Fill and Kill) and FOK (Fill or Kill) orders are also supported.

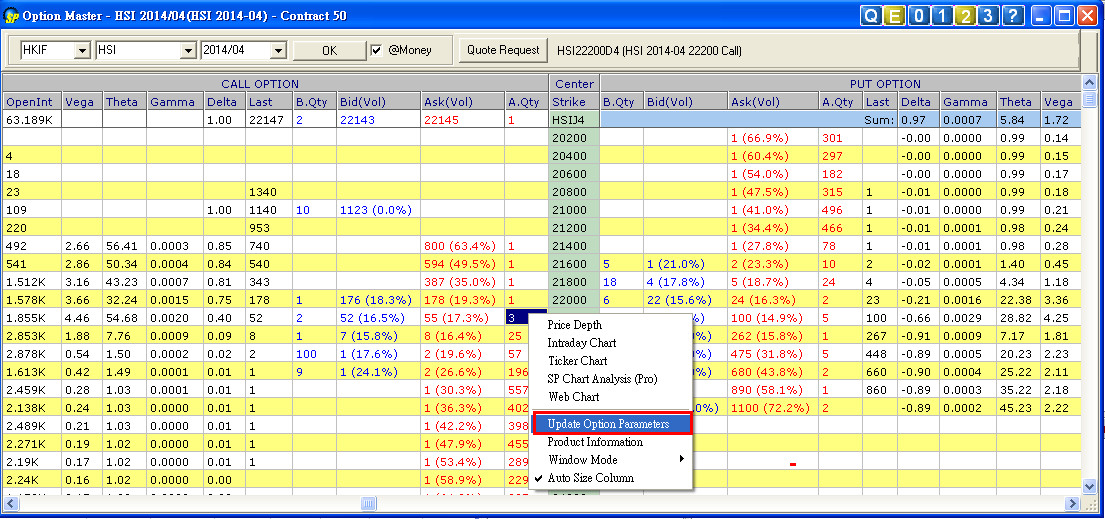

Update Option Parameters

This function permits client to update the option parameters (e.g. Implied Volatility, Delta, Gamma…) instantaneously if needed.

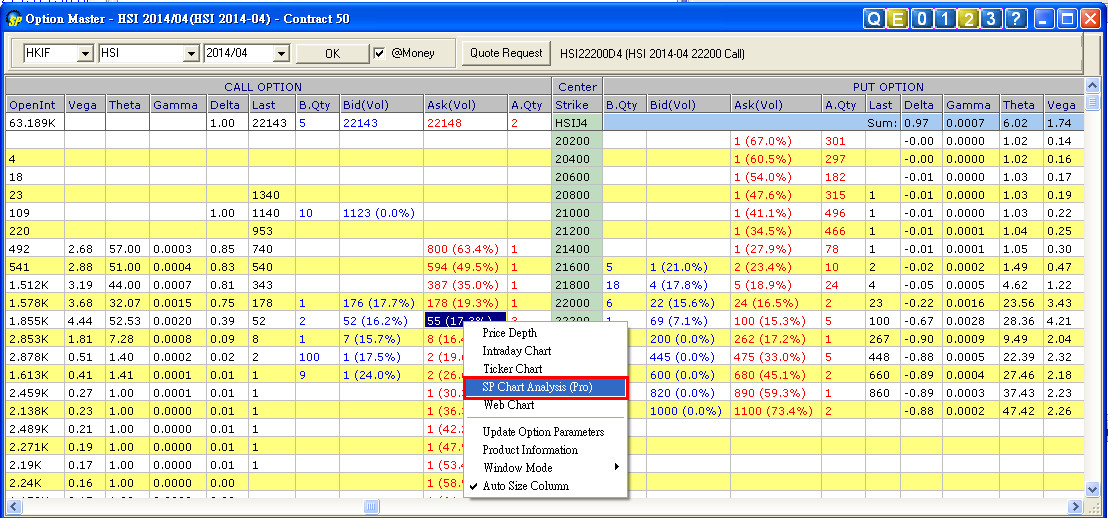

Option Chart (Professional)

User can right click the window to open the option professional chart

This winodw shows the intraday and volume chart, as well as other tools for chart analysis on options trading