Auto Spreader

User can do arbitrage of different products of global market via the [Spreader Order] function. Besides, user can do arbitrage between China market and global market via the [CTP] function.

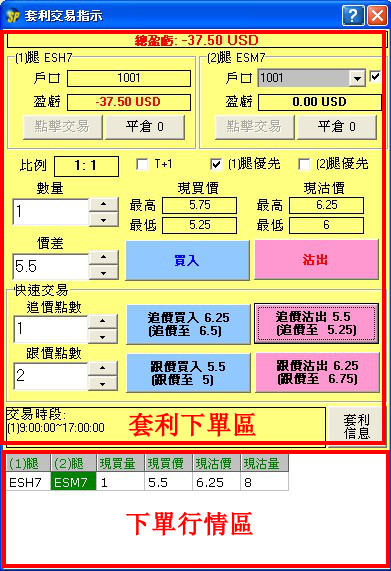

Spreader Layout areas are as :

(1) Spreader Product Area

(2) Spreader Order Area

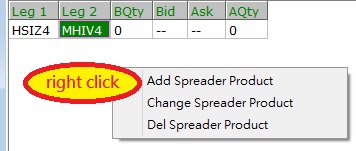

(1)Spreader Product Area:

How to Use: Base on your spreading formula, you can set 2 contracts and 2 products in Spreader Product area, it will show the price difference. Right click to Add, Change or Delete your Spreader Product.

Spreader Product Price Difference Calculation:

Formula:1 Leg Price— (2 Leg Price x Exchange Rate x Value)

Bid Price:1 Bid Price—(2 Ask Price x Exchange Rate x Value)

Ask Price:1 Ask Price —(2 Bid Price x Exchange Rate x Value)

Bid Qty:1 Bid Qty and 2 Ask Qty get the smallest one

Ask Qty:1 Ask Qty and 2 Bid Qty get the smallest one

Operations:

1. Add Spreader Product

In the Spreader Product area, right click and select “Add Spreader Product” :

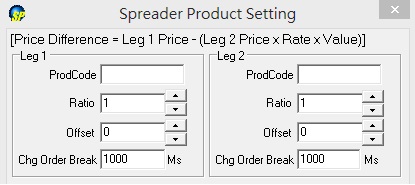

Add Spreader Product show as below picture:

ProdCode:1 Leg and 2 Leg Product code. (Notice: 1 Leg open to Global Product and Mainland Product, 2 Leg is limit to Global Product)

Ratio: 1 Leg and 2 Leg order quantity ratio

Offset:1 Leg and 2 Leg process trace price order

Change Order Break: Once order trigger,one of spreader products deal,system will check if another deal or not. If not, system will process synchronize deal which base on your “Change Order Break”and trace price in the market and deal the product as fast as it can to avoid asynchronous deal.Notice: Both global products and change order base .If 1 Leg product is Mainland futures,it will base the change time withdraw the order and reorder because Mainland futures do not support order change function.

Value: a strategic trade value set by user

Exchange Rate: 2 Leg contract trade currency change to 1 Leg contract trade currency Exchange Rate.

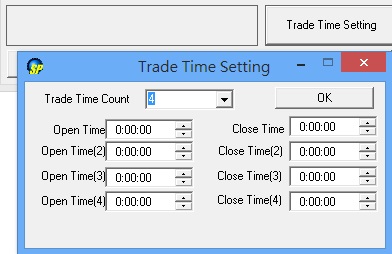

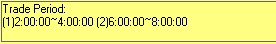

Set Trade Period:

1. “Trade Period”

Trade Periodis 1 Leg and 2 Leg both contracts are on “market open” trade hours . Time Setting uses 24 hours system. The longest time length is 24 hours. When “market close” smaller than “market open” means cross day trade. If “market open” equals “market close” ,means it is a 24 hour trade. Trade period can set maximum 4 periods and at least 1 period must include. Among trade periods should not exceed 24 hours. Furthermore, trade time should not overlap and the total should not exceed 24 hours.

2. Change Spreader Product

Edit your added spreading order

3. Delete Spreader Product

Cancel the spreading order

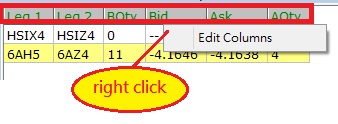

4. Edit Columns

Set hide or show the columns.

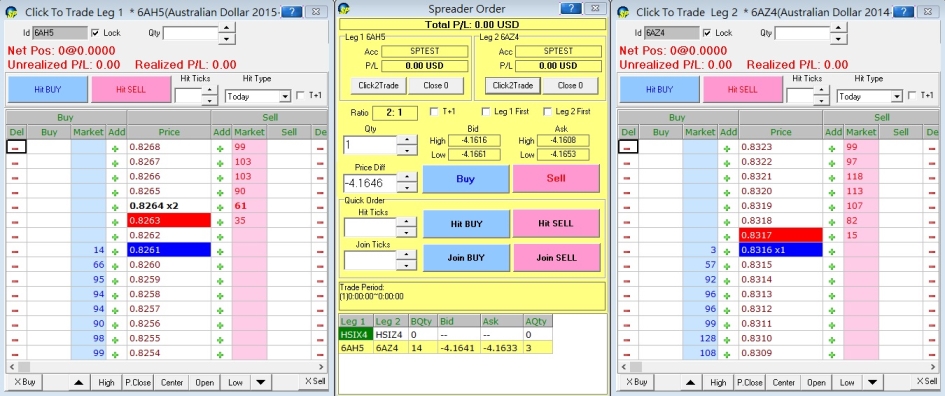

(2) Spreader Order Area:

Click the product in“Spreader Product”area, product will add to “Spreader Order”。

Reminder:

Spreader Product User Information:

Total P/L:2 Leg Profit and Loss count on pre-set Exchange Rate to 1 Leg, Total Profit and Loss of 2 contracts.

Net Position:1 Leg and 2 Leg Total Net Position quantity

Acc:1 Leg and 2 Leg Log-in Account

P/L:1 Leg and 2 Leg Profit and Loss

Click2Trade:Open 1 Leg and 2 Leg“Click2Trade”to do Open position and Offset

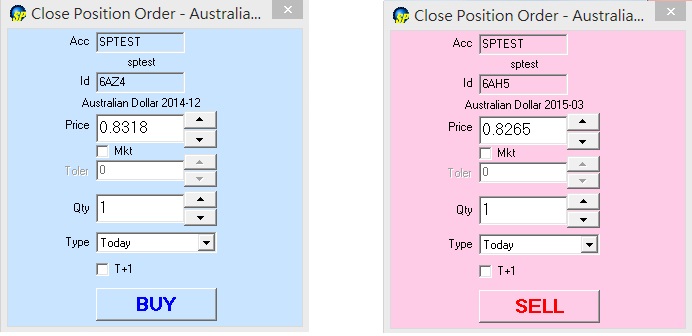

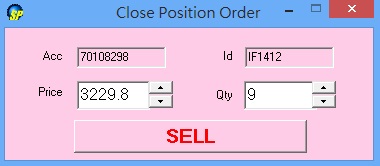

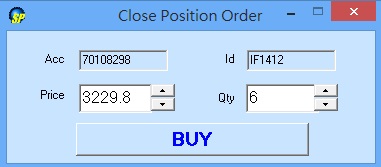

Close Position:

Notice:Mainland Futures market allows select Close either Long Position or Short Position

Close long:

Close short:

Order QtyQty x Ratio

Ratio:1 Leg and 2 Leg order ratio(1 Leg:2 Leg)

Qty:Ratio of order sets(Example:Ratio:1:2,Qty:2,Order Qty:1 Leg 2x1=2,2 Leg:2x2=4)

T+1:This item only for global future with night market support

Leg First:Choose which Leg deal order prior than another Leg to execute

Bid Price and Ask Price High and Low:Show the highest and lowest price of your spread order strategy

Price Diff:Price differences between 2 orders

Hit Ticks and Join Ticks:

Ticks multiply the 2 Contracts price difference of the smallest and the least vary digits(Hit to and Join to)

Trade Period:

Trading hours of your spreading trade set

User can open the [Spreader Info] Window by pressing the [Spreader info] button in the [Spreader Order] Window.

Reminder:

Spread Order Area:After add spread order, correspond order information and status will show on below area. You can click button“Delete”and“Delete All”to cancel one or all orders.

Spread Deal Area:If order dealt, (Both contracts dealt),deal information will show in this area.

How to Use:

1:Spread Order Area Right click can operate “ Start”,“Stop”and“Delete”orders. Right click list also included “Start All” and “Stop All”to Start or Stop all orders in one click.

2:Spread Order Area orders are queuing on server. Only if price difference triggers, order sends to exchange market.

Notice:If you have CTP trade,there are“Order Area”,“Order Log Area”and Trade Window“Trade Record”topic have a row of“Spreader number”。When user place“spreader”will show a serial number,otherwise it is empty。