CTP Login

User can login Shanghai Futures CTP via SPTrader, thus can do trades by connecting to the four main Futures Exchanges in mainland China, i.e., Zhengzhou Commodity Exchange, Shanghai Futures Exchange, Dalian Commodity Exchange,and China Financial Futures Exchange.

How to Use:

1.Select "CTP-->CTP Login" in sptrader under the "Tools" Manual.

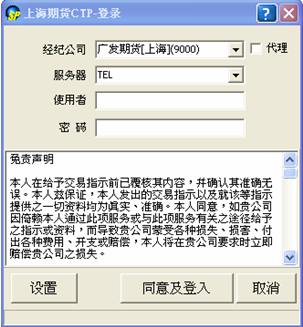

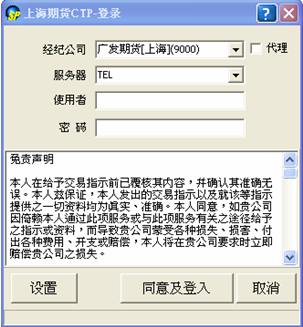

2.CTP Login interface is for Mainland China futures trading。Brokerage firm, Server, User Id and Password are provided by user's broker.

Steps:

1.If user cannot find the CTP brokerage firm from the list, or would like to use proxy login, please click “Settings” button for advanced configurations.(Sample as below)

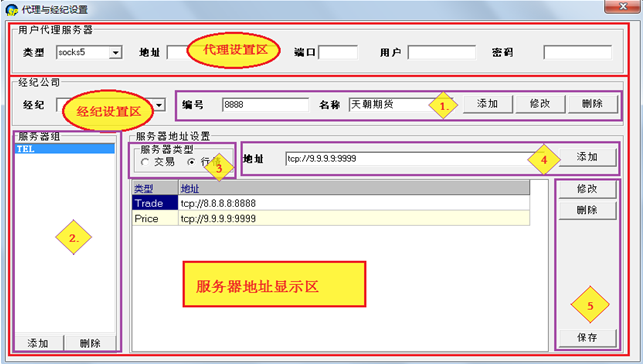

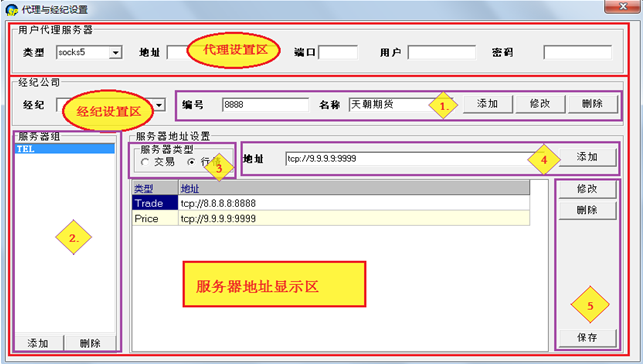

2.Proxy and Brokerage firm setting includes:"Proxy Setting Region" and "Brokerage Firm Setting Region"。

-Proxy Setting Region:To set Proxy server please select Server Type: "Trade" or "Price" first. Then enter the Proxy server address, Port, User and Password then click “Save” to apply.

-Brokerage Firm Setting Region:This area is for broker settings. Setup steps are as belows in different areas:

*Area 1、Type in "Broker" , "Number" and "Name" and click "Add" to apply.

*Area 2、Click "Add group" to build a "Server Group"(e.g.CT, CNC)

*Area 3、Select Server Type:“Trade”or “ Price”

*Area 4、Input Trade and Price server address respectively (Format:tcp://Address:Port) and click “Add”. The server settings can be seen below if successfully added.

*Area 5、Click "Save"

User can also edit or delete brokerage firm settings.

How to Use:

1.Select "CTP-->CTP Login" in sptrader under the "Tools" Manual.

2.CTP Login interface is for Mainland China futures trading。Brokerage firm, Server, User Id and Password are provided by user's broker.

Steps:

1.If user cannot find the CTP brokerage firm from the list, or would like to use proxy login, please click “Settings” button for advanced configurations.(Sample as below)

2.Proxy and Brokerage firm setting includes:"Proxy Setting Region" and "Brokerage Firm Setting Region"。

-Proxy Setting Region:To set Proxy server please select Server Type: "Trade" or "Price" first. Then enter the Proxy server address, Port, User and Password then click “Save” to apply.

-Brokerage Firm Setting Region:This area is for broker settings. Setup steps are as belows in different areas:

*Area 1、Type in "Broker" , "Number" and "Name" and click "Add" to apply.

*Area 2、Click "Add group" to build a "Server Group"(e.g.CT, CNC)

*Area 3、Select Server Type:“Trade”or “ Price”

*Area 4、Input Trade and Price server address respectively (Format:tcp://Address:Port) and click “Add”. The server settings can be seen below if successfully added.

*Area 5、Click "Save"

User can also edit or delete brokerage firm settings.

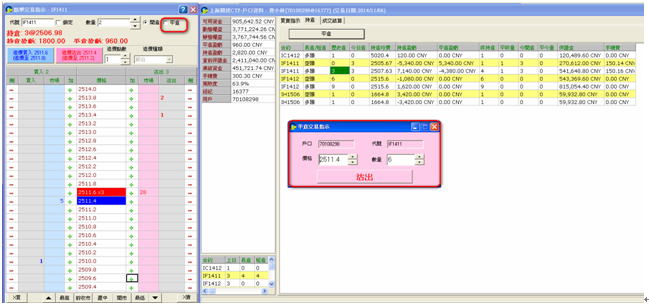

CTP Account Info

CTP account liquidity and trade informations can be searched in “CTP Account Info” window.

The window layout is divided into 2 parts.Left side is the “Account Info Area”(Include Account info and Positions):

How to Use :

Account Liquidity Area:Show your account liquidity information

Net Position Area:Show your net position information

Right side is the "Order Information Area"(Includes order, trades and position information)

The window layout is divided into 2 parts.Left side is the “Account Info Area”(Include Account info and Positions):

How to Use :

Account Liquidity Area:Show your account liquidity information

Net Position Area:Show your net position information

Right side is the "Order Information Area"(Includes order, trades and position information)

CTP Market Price

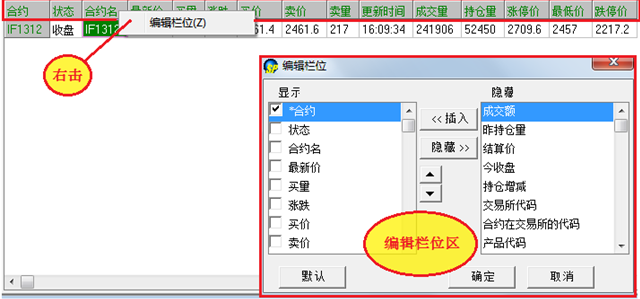

Before trading users can open “CTP Market Price” to check CTP market products quotes.

Layout:

-Contracts Area:CTP products and contracts can be searched in the price tree.

-Price Area:Show subscribed contracts' price informations

Descriptions:

1.Price List: There are 10 default price lists,each price list can show up to 100 contracts.

2.Price subscription- 2 methods can be used:

*Select the contract in Contracts Area, hold the mouse button and then drag and drop the contract to the right hand side page.

User can also select contracts of the same product type at once. Example:There is product type "Futures" under the product "IF" in price tree.Mouse-click on "Futures" and move to the right hand side page,and all "IF" futures contracts can then be seen) 。

*User can insert price by selecting “Insert” after right click in Price Area, Or Press “Insert” button on your keyboard when you are in Price Area

3.Price unsubscription - 4 methods can be used:

*Drag and drop your contracts from Price Area to Contracts Area.

*In Price Area Right click on contracts choose "Remove Price"

*Right click and choose "Clear Price List" to unsubscribe all contracts' price queries

*Press “Delete” on keyboard to unsubscribe contracts(user can select more products using keyboard by "Shift+ Up/Down Arrow" button, and press“Delete”/Right-click choosing “Remove Price” to unsubscribe)

4.Rename Price List:

Right click on the Price Area and select "Rename Price List" to edit Price List Tab name.

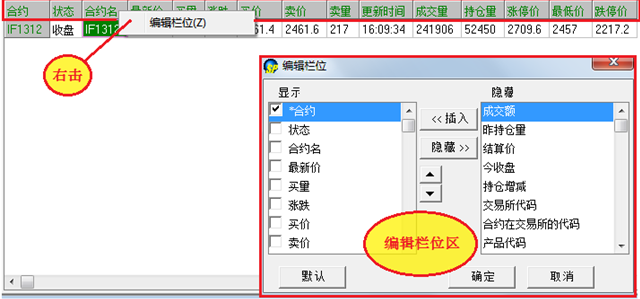

5.Edit Columns:Right click on the column header and choose "Edit Columns":

Edit Columns Area:Edit Columns window show two columns: “Shown” and “Hidden”.User can edit columns' content through “Insert” and “Hidden” buttons.

Other features include:

-The “Up/Down" button can help to change column sequence

-The “Default” button will resume columns' default sequence and content.

-The multiple check-boxes beside each field under "Shown" Area is for locking purpose. If a box is check, that field will be locked and mandatory shown on Market Price window.

Layout:

-Contracts Area:CTP products and contracts can be searched in the price tree.

-Price Area:Show subscribed contracts' price informations

Descriptions:

1.Price List: There are 10 default price lists,each price list can show up to 100 contracts.

2.Price subscription- 2 methods can be used:

*Select the contract in Contracts Area, hold the mouse button and then drag and drop the contract to the right hand side page.

User can also select contracts of the same product type at once. Example:There is product type "Futures" under the product "IF" in price tree.Mouse-click on "Futures" and move to the right hand side page,and all "IF" futures contracts can then be seen) 。

*User can insert price by selecting “Insert” after right click in Price Area, Or Press “Insert” button on your keyboard when you are in Price Area

3.Price unsubscription - 4 methods can be used:

*Drag and drop your contracts from Price Area to Contracts Area.

*In Price Area Right click on contracts choose "Remove Price"

*Right click and choose "Clear Price List" to unsubscribe all contracts' price queries

*Press “Delete” on keyboard to unsubscribe contracts(user can select more products using keyboard by "Shift+ Up/Down Arrow" button, and press“Delete”/Right-click choosing “Remove Price” to unsubscribe)

4.Rename Price List:

Right click on the Price Area and select "Rename Price List" to edit Price List Tab name.

5.Edit Columns:Right click on the column header and choose "Edit Columns":

Edit Columns Area:Edit Columns window show two columns: “Shown” and “Hidden”.User can edit columns' content through “Insert” and “Hidden” buttons.

Other features include:

-The “Up/Down" button can help to change column sequence

-The “Default” button will resume columns' default sequence and content.

-The multiple check-boxes beside each field under "Shown" Area is for locking purpose. If a box is check, that field will be locked and mandatory shown on Market Price window.

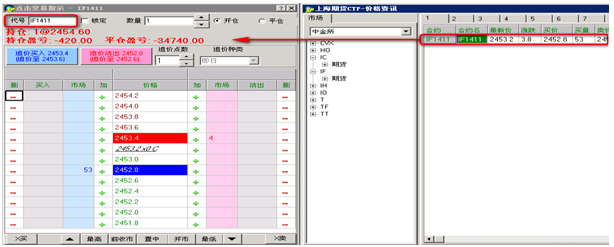

CTP Orders & Trades

(A)Trading - Order placing

How to use:

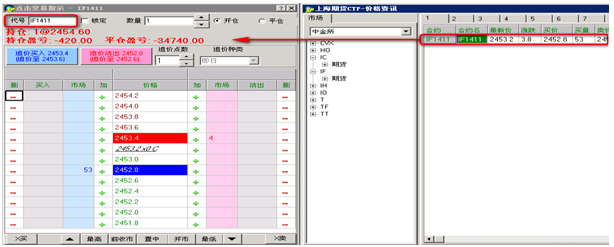

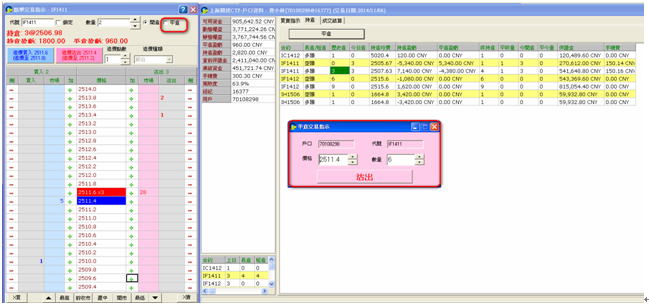

After login and querying the CTP Market prices ,user can use “Click To Trade” function(Under "Order" Manual) to place orders and close positions.

Operations:

User can click the contract in“CTP Market Price”window to update the code to “Click To Trade” window. Prices will then be shown and user can place orders following "Click To Trade" operation methods.

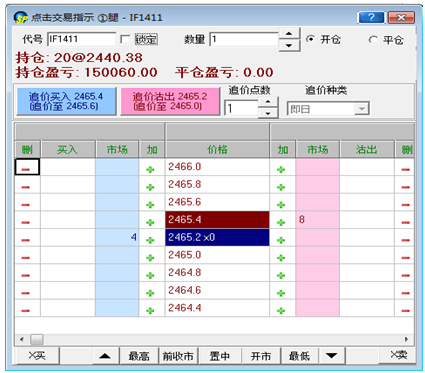

1.Add order

New order added will be displayed in "Order" book in CTP Account Info window.

2.Change/Delete orders

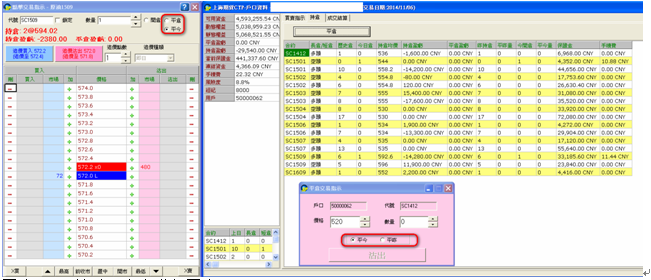

Inside“CTP Account Info” window,the right hand side is Order Information Area(includes: Order、Position、Clear Trade)

Remark:If the order is through SP's autospreader function, there will be an "Arb_Order ID" displayed in "CTP Account Info" window(both order and trades).Otherwise it will leave blank.

How to use:

Order Area:Show the order status

Order Log Area:Show the order log

Operations:

You can change or delete orders insde "Order Area".

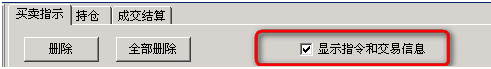

1.1: Delect/ Delect All: Two buttons "Delect" and "Delect All" are shown.The former one helps to delect a selected order, while the latter is to delect all pending orders.

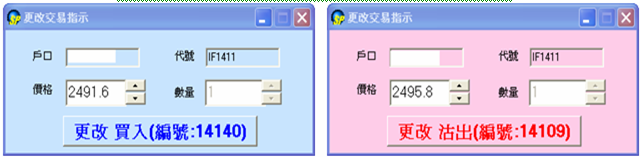

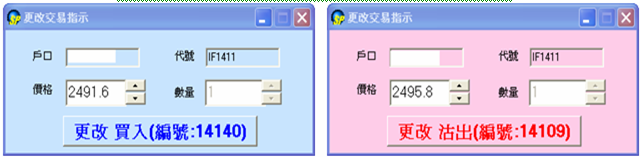

1.2: Change order: Double click an order in order book to change order , just as displayed below:

3.Show Order& Trade Message:

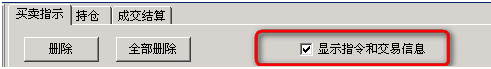

Pop-up messages on order informations will be shown while “Show Order&Trade Message” is default checked。If unchecked, informations will not pop-up.

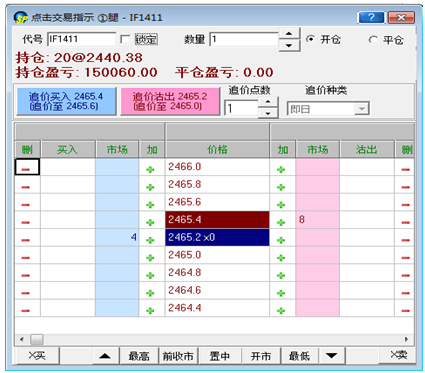

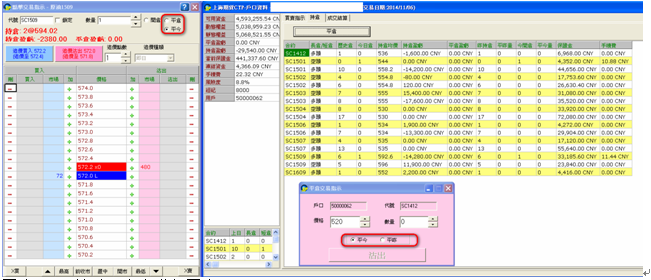

(B)Position informations

How to use:

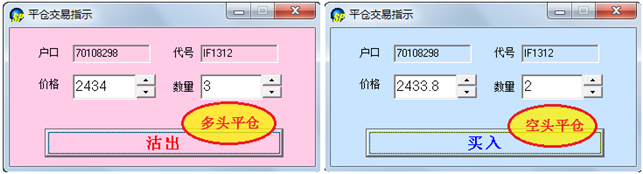

To show the position information. The main difference between Mainland and Foreign Futures is that Long position and Short position will be shown separately.(Example:Suppose a long order and a short order are traded, then there will be 2 positions , one long and one short. These two positions have to be closed respectively.)

Operations:

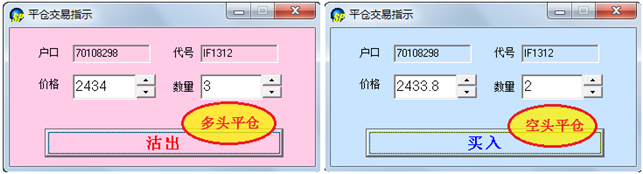

1. There is a “Close Pos” button for user to close positions, which is just as below:

2.YdPosition:Today Net position before settlement(YPosition - CloseYPosition = YdPosition)

3.Position:Today Net position(OpenVolume - CloseVolume = Position)

4.YPosition:Today position before settlement

5.CloseYPosition:Qty of today closed YdPosition

6.OpenVolume:Qty of today open positions

7.CloseVolume:Qty of today closed positions

Remark: Close position method for SHFE and Non-SHFE products is different:

SHFE's close position method can be "Close" or "Close Today":

Close: Close YdPosition only

Close Today: Close today's positions only, and will not close YdPosition

For Non-SHFE Exchanges(e.g.CFFEX), it has to close YdPosition first, then today's positions

(C)Clear Trade

How to Use:

Show users today trade log.

How to use:

After login and querying the CTP Market prices ,user can use “Click To Trade” function(Under "Order" Manual) to place orders and close positions.

Operations:

User can click the contract in“CTP Market Price”window to update the code to “Click To Trade” window. Prices will then be shown and user can place orders following "Click To Trade" operation methods.

1.Add order

New order added will be displayed in "Order" book in CTP Account Info window.

2.Change/Delete orders

Inside“CTP Account Info” window,the right hand side is Order Information Area(includes: Order、Position、Clear Trade)

Remark:If the order is through SP's autospreader function, there will be an "Arb_Order ID" displayed in "CTP Account Info" window(both order and trades).Otherwise it will leave blank.

How to use:

Order Area:Show the order status

Order Log Area:Show the order log

Operations:

You can change or delete orders insde "Order Area".

1.1: Delect/ Delect All: Two buttons "Delect" and "Delect All" are shown.The former one helps to delect a selected order, while the latter is to delect all pending orders.

1.2: Change order: Double click an order in order book to change order , just as displayed below:

3.Show Order& Trade Message:

Pop-up messages on order informations will be shown while “Show Order&Trade Message” is default checked。If unchecked, informations will not pop-up.

(B)Position informations

How to use:

To show the position information. The main difference between Mainland and Foreign Futures is that Long position and Short position will be shown separately.(Example:Suppose a long order and a short order are traded, then there will be 2 positions , one long and one short. These two positions have to be closed respectively.)

Operations:

1. There is a “Close Pos” button for user to close positions, which is just as below:

2.YdPosition:Today Net position before settlement(YPosition - CloseYPosition = YdPosition)

3.Position:Today Net position(OpenVolume - CloseVolume = Position)

4.YPosition:Today position before settlement

5.CloseYPosition:Qty of today closed YdPosition

6.OpenVolume:Qty of today open positions

7.CloseVolume:Qty of today closed positions

Remark: Close position method for SHFE and Non-SHFE products is different:

SHFE's close position method can be "Close" or "Close Today":

Close: Close YdPosition only

Close Today: Close today's positions only, and will not close YdPosition

For Non-SHFE Exchanges(e.g.CFFEX), it has to close YdPosition first, then today's positions

(C)Clear Trade

How to Use:

Show users today trade log.